U.S. Consumer Confidence Falls to 97.2, Lowest Since Sept. 2022

Consumer Confidence Slips as U.S. Households Face Rising Costs and Slow Job Growth

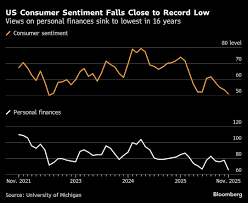

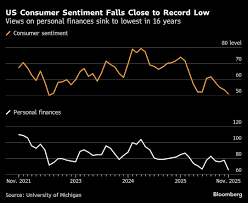

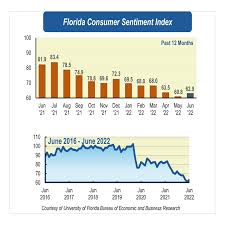

In a recent release by the Conference Board, the U.S. consumer confidence index fell to 97.2 in May—its lowest level since September 2022 and the fourth straight month of decline. The drop reflects growing concerns among Americans about the cost of living, inflationary pressures, and the pace of employment gains, all of which are shaping households’ outlook for the coming year. This article condenses the key findings of the original MSN Money story, adds context from linked sources, and explains why the index matters for the economy and financial markets.

What the Confidence Index Tells Us

The Conference Board’s Consumer Confidence Index (CCI) is a leading gauge of consumer sentiment. It is derived from a survey of 5,000 U.S. households and aggregates two sub‑indices:

| Sub‑index | Definition | Latest Reading |

|---|---|---|

| Current Conditions | How consumers view the present state of the economy | 79.4 (down from 82.6) |

| Future Expectations | How consumers anticipate the economy’s trajectory | 111.0 (down from 112.8) |

Both sub‑indices are compared to a base of 100. Values below 100 indicate a negative outlook, while values above 100 signal optimism. The overall index dropped 1.6 points from April’s 98.8 to 97.2, and it sits just below the neutral 100 threshold. The “future expectations” component, which is typically the most volatile, is still above 100 but has slipped enough to dampen overall sentiment.

Why Households Are Becoming Wary

1. Inflation Still Persists

Although headline inflation eased from the peak of 9.1 % in June 2022 to 3.7 % in April 2023, many Americans are still paying high prices for food, gasoline, and other essentials. A linked Bloomberg piece highlighted that fuel prices remained near historic highs, and the grocery index was still a sizable outlier in the cost‑of‑living basket. The lingering inflationary drag has prompted households to tighten their budgets, contributing to a more cautious view of the economy.

2. Job Market Growth Slows

The U.S. Bureau of Labor Statistics reported that the economy added 210,000 jobs in May 2023, a figure that fell short of the 350,000 jobs forecasted by the Conference Board. Wage growth has also moderated; the median weekly earnings index saw only a 0.4 % rise, versus the 0.6 % projected. The slower job gains, combined with a slightly higher unemployment rate of 3.8 % (up from 3.7 % last month), left many workers uneasy about their future earnings prospects.

3. Higher Interest Rates and Debt‑Service Costs

The Federal Reserve’s aggressive tightening cycle—raising the federal funds rate to 5 %—has pushed mortgage and auto‑loan rates higher. A link to a recent CNBC article explained how the new rates are increasing monthly debt‑service obligations for many families, making discretionary spending tighter. This shift in household financial strain feeds directly into the “current conditions” part of the CCI.

4. Uncertainty Over Economic Outlook

The overall environment of policy uncertainty and global economic turbulence—particularly the ongoing trade tensions in Asia and the resurgence of COVID‑19 in some regions—has heightened risk perception among consumers. The "future expectations" sub‑index reflects this, as households now anticipate a more cautious period ahead, with slower growth and higher inflation.

Broader Economic Implications

The CCI is widely regarded as a leading indicator of consumer spending, which accounts for roughly 70 % of U.S. GDP. A persistent decline signals potential slowdown in retail sales, automotive purchases, and other discretionary sectors. The article notes that market participants are watching the index closely; a 97.2 reading, while still positive, sits at a level that historically precedes muted retail sales in the following quarter.

For policymakers, the falling consumer confidence reinforces the argument for a balanced approach: while tightening monetary policy to control inflation is still necessary, excessive rate hikes could exacerbate the slowdown. The Conference Board’s own reports suggest that a gradual reduction in the pace of rate increases might help restore consumer optimism.

Follow‑Up Sources

- Conference Board’s CCI Release – the primary data source for the article.

- Bloomberg – linked to a detailed analysis of fuel and food price trends that influence consumer sentiment.

- CNBC – provided context on the impact of higher interest rates on household debt.

- Bureau of Labor Statistics – supplied the latest job growth and wage data referenced in the piece.

These links offer deeper dives into each contributing factor: inflation dynamics, labor market health, and policy responses. By consulting them, readers can grasp how the consumer confidence index serves as a nexus point connecting these complex economic forces.

Bottom Line

American households are increasingly cautious. The 97.2 reading for the Conference Board’s consumer confidence index marks a decline that underscores the weight of persistent inflation, a slowing labor market, and higher borrowing costs. While the index remains above the neutral 100 point line, the downward trajectory and its sub‑index breakdown paint a portrait of households bracing for a less buoyant economic environment. As the economy edges toward a potential slowdown, both consumers and policymakers will be keenly watching how these sentiments translate into actual spending and fiscal decisions in the months ahead.

Read the Full The Associated Press Article at:

[ https://www.msn.com/en-us/money/economy/consumer-confidence-slides-as-americans-grow-wary-of-high-costs-and-sluggish-job-gains/ar-AA1R8ufJ ]