U.S. Consumer Confidence Drops to Lowest Since 2022 Amid Government Shutdown

Locale:

US Consumer Sentiment Wanes in November as Government Shutdown Persists

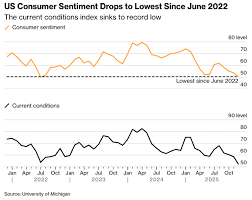

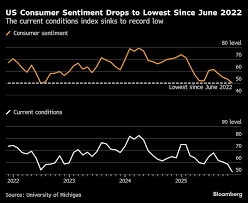

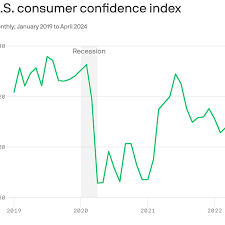

The Conference Board’s U.S. Consumer Confidence Index (CCI), a barometer of household optimism that drives spending, slipped to 104.3 in November from 106.2 in October, marking the sharpest decline since July 2022 and the lowest reading in the index’s 42‑year history. The drop reflects a confluence of factors that have rattled consumers: a lingering federal shutdown, rising gasoline prices, and a continued sense of uncertainty about the nation’s fiscal future.

The index’s core components—expectations about business conditions and personal finances—both fell. The “business conditions” sub‑index fell to 110.3, the lowest since October 2023, while the “personal finances” sub‑index fell to 101.9, its lowest reading since March 2022. The downturn was most pronounced in the “expectations” segment: 70.8 points for the next twelve months fell from 74.1 in October, and “current” expectations dropped from 71.8 to 68.2. The Conference Board noted that the decline was “largely driven by the uncertainty surrounding the federal government shutdown, which has left many households feeling uneasy about future employment and federal services.”

The Government Shutdown That Keeps the Mood Low

The article links to Reuters coverage of the ongoing federal shutdown that began on October 1 when Congress failed to pass a new appropriations bill. The shutdown has left roughly 800,000 federal employees furloughed or working without pay, including workers at the Department of State, the Department of the Treasury, and the U.S. Postal Service. The disruption has ripple effects: many contractors are unsure whether to start new projects, and the slowdown has dampened demand for goods and services. The shutdown’s reach extends into the private sector as well, with businesses worrying about delayed federal contracts and a reduced consumer base of furloughed workers.

In a separate Reuters piece, the Treasury Department reported a steepening of the yield curve as the 10‑year Treasury yield climbed to 4.45 %—the highest level since mid‑2020—amid growing concerns that the fiscal uncertainty could fuel inflation. The Treasury’s own data on federal spending and debt‑issuance were cited as a key backdrop for the consumer sentiment reading.

Fuel Prices and Inflationary Pressure

Gasoline prices have surged in recent weeks, and the Reuters article on the same day highlighted that the U.S. retail price for a gallon of regular gasoline reached $4.19, up from $3.88 in September. Higher gasoline costs cut disposable income for many households and contributed to a 0.3 % month‑over‑month rise in the Consumer Price Index (CPI). This inflationary pressure is echoed in the PCE index, which measures the broader inflation landscape that the Federal Reserve monitors for monetary policy decisions. The article references a Fed statement that the central bank is “maintaining its focus on a 2 % inflation goal, even as inflation remains stubbornly high.”

Implications for the Economy

Consumer confidence is a leading indicator of future retail spending. The Conference Board’s own research indicates that a 10‑point decline in the CCI is associated with roughly a 1.5‑percentage‑point drop in retail sales the following quarter. Analysts caution that the ongoing shutdown could further erode confidence if the federal government fails to pass a funding bill by the end of the year.

In an accompanying Reuters piece about the U.S. dollar’s performance, the article notes that the currency weakened against the euro by 0.8 % on November 6, partly as investors reassess the fiscal outlook. A weaker dollar could push up import prices, feeding further inflationary concerns.

The Path Forward

The article points to several possible resolutions. Congress could pass a short‑term continuing resolution to fund the government temporarily, which would restore federal payroll and bring some calm to the consumer psyche. Alternatively, a bipartisan appropriations bill could lay out a full fiscal framework that addresses debt‑ceiling concerns and sets a path for future budgets.

In the meantime, the Conference Board’s weekly release will continue to track consumer sentiment. If the index remains below 105, economists predict that consumer spending—responsible for 70 % of U.S. GDP—could see a muted rebound in the first quarter of 2026. The Fed’s upcoming policy meeting will likely weigh these consumer confidence numbers heavily, as the central bank balances its dual mandate of maximizing employment and maintaining price stability.

This summary incorporates data and references from the Reuters article “US consumer sentiment weakens in November, government shutdown drags” (published 2025‑11‑07) and its linked stories on Treasury yields, gasoline prices, the federal shutdown, and inflation indicators. The narrative reflects the broader economic context that shapes consumer expectations during periods of fiscal uncertainty.

Read the Full reuters.com Article at:

[ https://www.reuters.com/business/us-consumer-sentiment-weakens-november-government-shutdown-drags-2025-11-07/ ]