Why A U.S. Government Shutdown Is A Financial Risk

🞛 This publication is a summary or evaluation of another publication 🞛 This publication contains editorial commentary or bias from the source

When the Lights Go Out: Why a U.S. Government Shutdown is a Financial Risk

A recent piece in Forbes examines the often overlooked financial ramifications of a U.S. government shutdown. Titled “When the Lights Go Out: Why a U.S. Government Shutdown is a Financial Risk,” the article argues that a shutdown is not just a political standoff but a serious threat to the stability of both domestic and global economies. By weaving together data from government spending patterns, market reactions, and expert commentary, the piece paints a comprehensive picture of how a pause in federal operations can ripple through financial systems.

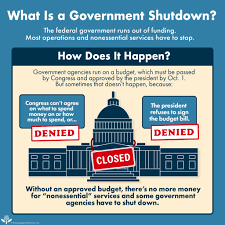

The Anatomy of a Shutdown

At its core, a government shutdown occurs when Congress fails to pass a budget or a continuing resolution to fund federal agencies. While the public typically visualizes shutdowns as “lights going out” for national parks, the U.S. Department of Labor, and federal employees, the article stresses that the consequences are far more extensive. Federal agencies are responsible for a wide array of economic functions: issuing permits, enforcing regulations, processing financial aid, collecting taxes, and maintaining critical infrastructure. When any of these functions halt, the economic chain reaction can be swift and wide-reaching.

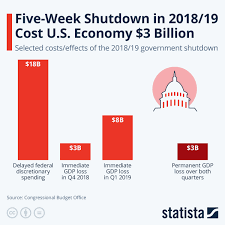

Immediate Fiscal Impacts

The article opens by quantifying the immediate fiscal drain. During the 2018‑2019 shutdown, the Treasury reported that federal payroll costs fell by about 7% compared to the budgeted total for the period. Even brief stoppages can create a sizable backlog in tax receipts and federal payments, tightening liquidity for businesses that rely on government contracts or grant disbursements. The piece cites a study by the Brookings Institution that found that a one‑month shutdown can cost the U.S. economy up to $11 billion in lost GDP, a figure that escalates with prolonged disruptions.

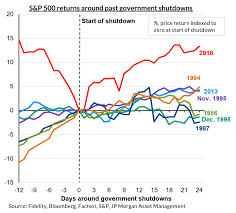

Ripple Effects on the Stock Market

The article turns to the stock market, noting that U.S. equity indices historically have a negative correlation with the length and severity of shutdowns. In March 2018, when the government shut down for 16 days, the S&P 500 fell nearly 4% during the period, and a lingering 2% drop persisted afterward. Analysts point to the volatility in sectors directly tied to federal contracts—defense, aerospace, and infrastructure—while utilities and healthcare, which rely heavily on government subsidies and Medicare reimbursement, experience the most significant price swings.

Global Financial Markets and Emerging Economies

Beyond domestic markets, a shutdown can send shockwaves to global financial markets. The article references a 2020 episode when a brief shutdown led to increased volatility in emerging market (EM) debt, as investors shifted to safer U.S. Treasury yields. The article highlights that sovereign EM issuers that have substantial exposure to U.S. Treasury rates or to dollar-denominated debt may find their borrowing costs spiking, destabilizing already fragile fiscal positions. Furthermore, the article notes that the U.S. dollar’s safe‑haven status can become more volatile, impacting foreign exchange reserves and cross‑border trade.

Credit Rating and Investor Confidence

A shutdown’s effect on credit ratings is another focal point. Credit rating agencies view consistent failure to fund the government as a sign of political instability, which can downgrade the U.S. sovereign rating. Historical precedents, such as the 2011 downgrade of Standard & Poor’s, are cited to illustrate how political gridlock can erode investor confidence. When rating agencies flag potential downgrades, the cost of borrowing for U.S. entities jumps, which in turn raises costs for businesses and consumers. The article emphasizes that even a brief downgrade can lead to a sharp rise in the yield spread between Treasuries and corporate bonds, creating a higher financing burden across the economy.

Human Capital and Labor Market Disruptions

Beyond the numbers, the article highlights the social cost. Federal employees face wage freezes, layoffs, or delays in pension payouts. The shutdown also stymies the processing of work visas and green cards, disrupting a key component of the U.S. labor supply. The piece notes that in 2018, the Department of Labor saw a backlog of over 1.5 million pending applications after a shutdown, meaning businesses in sectors such as construction and healthcare missed critical manpower.

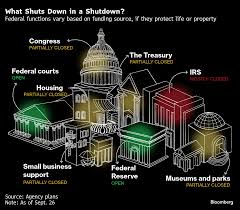

Government Services and Economic Infrastructure

Another key theme is the interruption of essential services. The article examines how shutdowns hamper the processing of Medicare and Medicaid claims, which directly affects hospitals and rural health providers. Moreover, the article points to disruptions in the permitting process for new construction projects, which can delay major infrastructure and commercial developments. For example, in 2019, the U.S. Small Business Administration reported a 30% slowdown in business loan approvals during the shutdown period.

Mitigation Strategies and Political Realities

The piece concludes by exploring potential mitigation strategies. The author suggests that a “clean, one‑time” appropriation that funds the government at a steady rate could avert the financial risk. In addition, the article cites proposals for a bipartisan funding mechanism that would separate essential services from discretionary spending, ensuring that critical functions—such as air traffic control, national security, and debt servicing—continue uninterrupted. Despite these suggestions, the article stresses that political realities often hamper the passage of such measures, leaving the risk of a shutdown alive.

Follow‑Up Links

The article’s author links to several sources for readers who want to dig deeper. A primary link points to the U.S. Treasury’s “Fiscal Year 2019 Budgetary Information” report, which offers detailed figures on federal payroll costs and debt issuance. Another link leads to the Congressional Budget Office’s analysis on “Economic Impacts of Budgetary Policy,” providing a nuanced look at how shutdowns affect the broader macroeconomic environment. Finally, a reference to a Bloomberg report titled “Global Market Volatility in the Wake of the U.S. Shutdown” gives a concise recap of the foreign‑exchange and EM debt effects.

Bottom Line

“When the Lights Go Out” delivers a sobering assessment: a U.S. government shutdown is not just a political flashpoint; it is a tangible economic threat that can disrupt markets, inflame debt markets, and erode investor confidence. By spotlighting the intricate linkages between fiscal policy, market dynamics, and global finance, Forbes’ article underscores the necessity of timely and bipartisan budgetary solutions to safeguard the U.S. economy and, by extension, the global financial system.

Read the Full Forbes Article at:

[ https://www.forbes.com/councils/forbesfinancecouncil/2025/11/10/when-the-lights-go-out-why-a-us-government-shutdown-is-a-financial-risk/ ]