Trump's Return Sparks Market Anxiety

Locales: New York, Washington, Florida, UNITED STATES

A History of Disruption

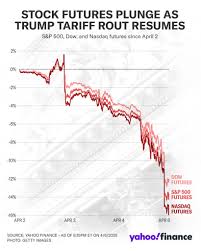

Throughout his previous term, Donald Trump's policies and pronouncements frequently injected volatility into the markets. His imposition of tariffs on Chinese goods triggered trade wars, creating uncertainty and impacting global supply chains. Moreover, his consistent skepticism toward the Federal Reserve, a pillar of US monetary policy, fostered a climate of instability and eroded investor confidence. These events served as a stark lesson for investors regarding the potential economic ramifications of a Trump presidency. The lessons have not been forgotten.

Uncertainty: The Market's Kryptonite

The fundamental problem isn't necessarily any single policy Trump might enact, but the overarching uncertainty he represents. Markets thrive on predictability, on the ability to forecast future trends and adjust investment strategies accordingly. Trump's tendency towards impulsive statements, his questioning of established norms, and his general unpredictability shatter that sense of stability. He disrupts the planning process, forcing investors to constantly re-evaluate risk and potential reward.

Beyond Policy: The Tone Matters

The anxieties extend beyond potential policy shifts. Trump's rhetoric - his criticisms of institutions, his challenges to longstanding principles - instills a deep-seated unease. While markets aren't perfectly rational entities - they are driven by human sentiment - those sentiments are highly susceptible to political messaging. The perception of systemic instability, fostered by aggressive and often provocative language, can trigger significant market reactions.

A Changed Landscape

Interestingly, during his prior presidency, the markets often appeared to shrug off Trump's pronouncements. This wasn't due to inherent resilience, but perhaps a delayed reaction or a hope that the rhetoric wouldn't translate into substantive policy. However, the market's perspective has evolved. Investors now possess a more acute awareness of the tangible risks associated with a Trump presidency. They've witnessed firsthand the detrimental impact of his policies and his volatile communication style. This heightened awareness fuels the current wave of anxiety.

Navigating the Uncertainty

The immediate future offers limited options for directly influencing Trump's behavior. Instead, the focus shifts to mitigating potential damage. For investors, diversification remains a crucial strategy, reducing exposure to sectors particularly vulnerable to Trump's policies, such as international trade and those heavily reliant on stable monetary policy. Risk mitigation techniques are also essential. A flight to safer assets - government bonds, for example - might be a considered approach.

Policymakers also have a role to play. Reinforcing the importance of economic stability and reaffirming commitments to responsible fiscal and monetary policies can provide a degree of reassurance, though the impact is likely to be limited given the inherent unpredictability of the situation. Clear and consistent communication from the Federal Reserve and the Treasury Department will be paramount.

The Ultimate Decision

Ultimately, the future of the market hinges on the choices of the electorate. Voters hold the power to decide whether to reinstate Trump and accept the potential consequences, or to chart a different course. The responsibility rests with them to weigh the potential benefits of his policies against the risks of heightened economic volatility and uncertainty. The markets are sending a clear message: the stakes are high.

Read the Full Berkshire Eagle Article at:

[ https://www.berkshireeagle.com/business/columnist/president-trump-threats-markets-churn/article_895185a6-045f-45f7-8cdd-7e850efb3d97.html ]