California Faces $38 Billion Deficit

Locales: California, UNITED STATES

A Rapidly Deteriorating Situation

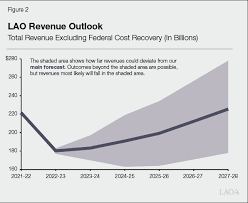

Just months ago, Governor Gavin Newsom's administration anticipated a $28 billion deficit. This number was swiftly revised upwards to $38 billion in November, demonstrating a concerning and rapid deterioration in the state's financial outlook. The LAO's latest assessment confirms this troubling trend. With a projected overall state budget of approximately $300 billion, a $38 billion deficit represents a substantial challenge.

According to Brent Newell, Director of the LAO, the situation is more dire than initially believed. The shortfall isn't the result of a single factor but a combination of slower-than-expected tax revenue growth coupled with existing, ongoing commitments that the state is obligated to fulfill. This underscores the difficulty in maintaining programs when revenue streams falter.

Impact Across Key Sectors

The ramifications of this deficit will be felt across a wide spectrum of Californian life. The LAO's report specifically highlights that critical areas like education, healthcare, and the state's significant climate initiatives are at risk. Education funding, crucial for schools and students across the state, could face reductions. Healthcare programs, vital for millions of Californians, may also see curtailed resources. And California's aggressive climate initiatives, designed to combat climate change and foster a green economy, are also vulnerable to cuts.

Navigating Difficult Choices

The responsibility of addressing this shortfall now falls on state legislators, who face a complex and politically charged decision-making process. Several options are on the table, each with its own potential consequences for California's residents. These options include:

- Program Cuts: Reducing funding for existing programs is a blunt instrument that could negatively impact essential services and potentially harm vulnerable populations.

- Delaying Spending: Postponing planned expenditures can provide temporary relief but risks exacerbating problems in the long run and delaying crucial projects.

- Raising Taxes: Increasing taxes is a politically sensitive option that could impact businesses and individuals, potentially hindering economic growth.

State Sen. Mike McGuire, D-Healdsburg, aptly described the coming months as requiring "tough choices." The legislature must carefully weigh the potential consequences of each action and strive to minimize the impact on Californians.

Economic Slowdown Adds to the Pressure

The situation is further complicated by a broader economic slowdown, which the LAO's report identifies as a contributing factor and a potential amplifier of the deficit. A weakening economy typically leads to reduced tax revenues, further straining the state's finances. This creates a vicious cycle that could be difficult to break.

Governor's Office Remains Silent

Notably, the Governor's office has declined to comment on the LAO's report, prompting speculation and increasing scrutiny of the administration's response to the growing financial crisis. This lack of immediate public engagement has left many wondering how the Newsom administration intends to navigate this challenging period.

Looking Ahead

The $38 billion shortfall presents a significant challenge for California. The decisions made in the coming months will have a profound impact on the state's economy, its public services, and the lives of its residents. The need for transparent communication, careful consideration, and potentially unpopular choices is now greater than ever.

Read the Full The Center Square Article at:

[ https://www.thecentersquare.com/california/article_aabf0189-90bf-45a0-8b26-79cc2ada7d70.html ]