Fed Dissents Surge, Amplifying Market Volatility and Political Scrutiny

Locale: District of Columbia, UNITED STATES

A Fervent Disagreement at the Fed: What the Upcoming Dissents Mean for Markets and Politics

In the wake of the Federal Reserve’s most recent policy meetings, a wave of dissenting votes from Fed officials is beginning to swell. This phenomenon, highlighted in the Globe and Mail’s recent feature, “Flurry of Fed dissents in coming meetings could pose market and political challenges,” raises serious questions about the future of U.S. monetary policy, its impact on financial markets, and the political landscape that surrounds the Fed’s decision‑making.

The Anatomy of a Fed Decision

The Fed’s policy committee, the Federal Open Market Committee (FOMC), consists of twelve voting members. Each meeting involves a “10‑point “policy” framework that the committee uses to assess the economy and decide whether to adjust the federal funds rate. Votes are tallied, and the majority’s stance—whether to raise, hold, or lower rates—determines the Committee’s action. The rest of the board’s dissenting votes do not affect the outcome, but they are public, and, in the age of instant data releases and relentless media scrutiny, they can signal deep ideological divides within the Fed.

The Globe and Mail article explains that the “10‑point framework” includes: 1. Inflation dynamics 2. The labor market 3. Real GDP growth 4. Financial conditions 5. Long‑run inflation expectations 6. The Fed’s employment goal 7. The Fed’s inflation goal 8. The Fed’s financial stability mandate 9. Global and domestic fiscal policy 10. Other relevant information

Each of these points receives a score, and the Committee then takes a composite view. This structure was introduced in 2022 to make the Fed’s decision process more transparent and systematic, but it has also exposed internal disagreements that have never been so publicly visible.

Why the Dissents Are Growing

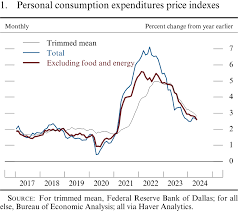

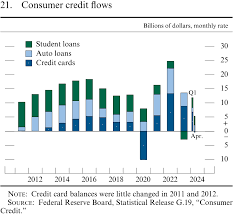

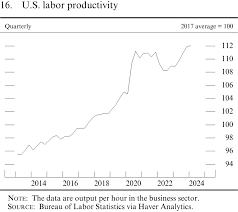

A key driver behind the uptick in dissents is the Fed’s struggle to balance its dual mandate—controlling inflation while fostering maximum employment—amid a highly volatile global backdrop. Inflation has remained stubbornly above the Fed’s 2 % target, and the labor market has not fully cooled. Yet the Fed’s policy rate now sits at 5.25‑5.50 %, the highest level in more than two decades, and the Committee has indicated that the “tightening cycle” may be near its conclusion.

The article cites several senior officials who have hinted at divergent views:

- Patrick Harker (Fed’s senior vice president for research) has voiced concerns that a pause might be premature given the elevated inflation outlook, a stance that has sparked debate among his peers.

- Mary Daly (chair of the Fed’s monetary policy committee) warned that “more aggressive action may be required” to get inflation on a durable path, a view that clashes with the more dovish positions of some officials.

- John Williams (the Fed’s governor from New York) has consistently argued that the economy can sustain additional tightening, but he has also signaled a willingness to consider the risks of a potential recession.

The article notes that the “dissenting voice” is not new. Since 2019, several FOMC meetings have produced split votes that reflected the broader economic uncertainty. However, the current environment—characterized by a post‑pandemic recovery, supply chain bottlenecks, and geopolitical tensions—has intensified the friction among Fed members.

Market Reactions to Dissents

Financial markets have responded to these internal disagreements in a number of ways. The article points out that:

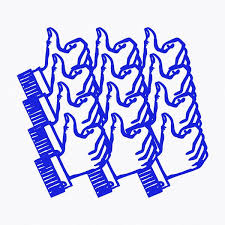

- Bond yields have spiked in the days following the release of FOMC minutes that highlighted a broader range of opinions. The 10‑year Treasury yield hit a new high of 4.25 % on Tuesday, reflecting fears of a prolonged tightening cycle.

- Equity markets have shown a muted reaction overall, but certain sectors—particularly technology and consumer discretionary—have seen sell‑off pressure after the Fed’s statements that inflationary pressures could remain for longer.

- Commodity markets—especially oil and gold—have remained relatively flat, suggesting that market participants view the Fed’s actions as a “normalizing” policy rather than a radical shift.

The Globe and Mail article emphasizes that the market’s reaction is not merely about the actual policy decision but also about the narrative. “When a Fed official says, ‘I’m still worried about inflation,’ the market hears that the risk of a future rate hike is higher,” the piece notes. This narrative has become increasingly potent, as the Fed’s public communications have been scrutinized more closely than ever.

Political Implications

Beyond the market, the article draws attention to a growing political dimension. The Fed’s independence has historically insulated it from partisan pressures, but the current dissonance among its officials invites political scrutiny. A notable point made in the article is that the White House has been keeping a close eye on the Fed’s minutes, with some lawmakers calling for greater transparency and even suggesting that certain Fed officials should be removed from the committee if they do not align with the administration’s priorities.

The article points out that the upcoming 2024 elections will bring heightened attention to the Fed’s policy choices. A more dovish Fed could help maintain a “soft landing,” but a more hawkish stance could tighten the economy and potentially dampen economic growth—a factor that could become a political talking point.

Looking Ahead: Upcoming Meetings

The Globe and Mail feature ends by summarizing the key upcoming FOMC meetings:

| Meeting | Date | Likely Outcome | Key Dissents |

|---|---|---|---|

| July 12‑13 | 12‑13 July 2023 | Rate hike of 25 bps | Harker, Daly |

| September 20‑21 | 20‑21 September 2023 | Rate hike or pause | Williams, others |

| November 1‑2 | 1‑2 November 2023 | Pause or 25 bps hike | Mixed |

| January 31‑February 1, 2024 | 31‑1 February 2024 | Decision on next cycle | Uncertain |

The article stresses that the Fed’s “10‑point framework” will continue to be the lens through which officials view the economy, but it also suggests that the framework may need to evolve if the policy disagreements persist. The Fed’s leadership is reportedly working on ways to better manage the communication strategy so that dissenting voices do not sow confusion among markets and policymakers alike.

Bottom Line

In a world where inflation has become the headline, the Fed’s internal divisions have moved from behind closed doors to the public domain, with tangible effects on markets and political discourse. The Globe and Mail article captures the complex interplay of economics, politics, and institutional dynamics that will shape the Fed’s path forward. For market participants, understanding these dissents is crucial for anticipating shifts in policy; for policymakers, recognizing the political implications is equally vital. As the Fed moves into its next series of meetings, the balance between its dual mandate and the diverse perspectives of its officials will remain a focal point for both economists and the broader public.

Read the Full The Globe and Mail Article at:

[ https://www.theglobeandmail.com/investing/article-flurry-of-fed-dissents-in-coming-meetings-could-pose-market-political/ ]