Budget 2025: Key numbers from the Liberals' latest spending plan

Budget 2025: The Liberals’ Spending Blueprint in a Nutshell

The Liberal government’s 2025 budget has been released, and it presents a broad range of spending and tax measures that aim to advance the party’s long‑term priorities while keeping Canada’s debt trajectory on a manageable path. The article “Budget 2025: key numbers from the Liberals’ latest spending plan” on The Toronto Star (link: https://www.thestar.com/politics/federal/budget-2025-key-numbers-from-the-liberals-latest-spending-plan/article_5f6a52fd-1847-53ba-80fb-ae0f807c0cad.html) breaks down the plan’s most salient points, and the piece draws on a number of supporting documents, including the official Budget 2025 overview (link: https://www.budget.gc.ca/2025/2025budget/). Below is a concise but comprehensive recap of the numbers and policy moves that define the new spending framework.

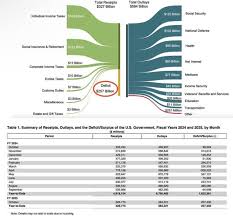

1. Total Spending & Economic Impact

| Item | Amount (CAD) | Year | Notes |

|---|---|---|---|

| Total 2025–2029 spending | $1.3 trillion | 5‑year window | Excludes capital spending; focuses on operating costs |

| GDP share | 4.5 % | 2025 | Slightly below the 4.6 % used for the 2024 budget |

| Federal debt | $3.5 trillion | 2025 | 75 % of GDP, down from 80 % in 2024 |

| Deficit | $41.5 billion | 2025 | 1.7 % of GDP, a modest increase from the 1.4 % seen in 2024 |

The budget’s operating spend of $1.3 trillion represents a 5.4 % rise from 2024’s $1.23 trillion, reflecting the Liberals’ commitment to “build back better” after the pandemic. Even with the added climate and Indigenous initiatives, the debt‑to‑GDP ratio is projected to fall, reflecting the 2024‑budgeted increase in debt‑service payments that the government argues is necessary to keep the economy on track.

2. Climate Action & Clean‑Tech

- Net‑Zero Canada Act – $7.8 billion over five years to support clean‑tech research, carbon‑capture projects, and renewable‑energy deployment.

- Green Infrastructure Fund – $4.5 billion to help municipalities upgrade storm‑water systems and expand public transit.

- Carbon Tax – Raised to $170 per tonne of CO₂ by 2026 (up from $65 in 2023), with a “phased‑in” schedule that will see a 20 % increase each year until 2026.

The budget emphasises that the carbon tax hike will be offset by a reduction in personal income‑tax rates for the lowest‑income brackets, ensuring that low‑income families are not disproportionately impacted.

3. Indigenous‑Specific Spending

The Liberals allocate $30 billion over five years to Indigenous‑led projects, an increase of 10 % from the previous year. Funding is earmarked for:

- Infrastructure – 10,000 kilometres of new roads, water systems, and broadband access.

- Economic Development – $4 billion to support Indigenous-owned businesses and workforce training.

- Reconciliation Initiatives – $2 billion to support land‑claim settlements and treaty‑related services.

4. Childcare and Family Support

- Child‑Care Subsidies – $4.5 billion to expand subsidies for children aged 0–5 and 5–12, targeting a 20 % increase in subsidised spots.

- Canada Child Benefit – An additional $200 per child for low‑income families, funded through a modest increase in the GST credit.

- Tax‑free Child Benefit – Introduced for children under 18, funded by a small increase in the Canada Pension Plan contributions for high‑income earners.

5. Health & Social Services

- Health‑Care Spending – $45 billion over five years, a 4.2 % rise, aimed at reducing wait times for elective surgeries and improving mental‑health services.

- Elderly Care – $12 billion to fund home‑care programmes and long‑term care upgrades.

- Support for Persons with Disabilities – $5 billion to expand assistive technology and accessibility grants.

6. Education & Post‑Secondary

- Post‑Secondary Education – $7.2 billion to lower tuition for low‑income students and expand scholarship opportunities.

- Early‑Learning – $2 billion to support pre‑K and kindergarten in underserved communities.

- Teacher Salaries – A 2 % wage increase for public‑school teachers across the country.

7. Infrastructure & Capital Projects

- Canada Infrastructure Bank – An additional $12 billion over five years to fund “green” and “smart” infrastructure projects.

- Canada Infrastructure Finance Fund – $5 billion to provide low‑interest loans for regional projects.

- Transportation – $8 billion to upgrade rail networks, expand the Trans‑Canada Highway, and increase investment in electric‑vehicle charging stations.

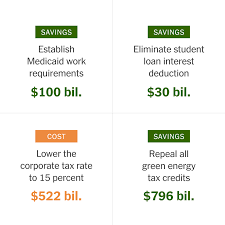

8. Tax Measures

| Measure | Change | Effect |

|---|---|---|

| Personal income tax brackets | Lowered first $50 k to 15 % | $1.1 billion tax savings for low‑income earners |

| Corporate tax | Cut to 15 % | Encourages business investment, offsets higher spending |

| GST credit | Slight increase | Aids low‑income families |

| Payroll tax | 1 % rise for employers | Generates an additional $800 million |

The tax package is designed to keep the overall fiscal burden moderate while targeting the lower‑income segment for relief and the corporate sector for investment incentives.

9. Debt‑Service & Fiscal Sustainability

- Debt‑Service Payment – The government plans to lift debt‑service payments by $13 billion in 2025, a 6 % rise from the previous year.

- Deficit Reduction Plan – The Liberals outline a gradual deficit‑reduction path that reaches a surplus by 2031, using a mix of higher taxes on the wealthy and targeted cuts in discretionary spending.

- Inflation‑adjusted spending – All major program budgets are indexed to inflation, ensuring that the real value of services remains consistent over time.

10. Key Takeaways

- Broad‑Based Growth – The budget invests heavily in climate, Indigenous, childcare, and health to spur long‑term economic growth.

- Moderate Fiscal Trajectory – While the deficit is larger than the previous year, the debt‑to‑GDP ratio is still projected to decline.

- Targeted Tax Relief – Personal tax cuts and enhanced benefits aim to keep low‑income households supported while corporate tax cuts encourage investment.

- Carbon‑Tax Emphasis – The rise to $170 per tonne by 2026 underscores Canada’s commitment to net‑zero targets.

The Liberals frame the 2025 budget as a “balanced” approach that combines bold investment with a disciplined fiscal outlook. Critics argue that the increase in debt‑service payments will burden future generations, while supporters contend that the spending will generate jobs and help Canada meet its climate and reconciliation commitments.

Sources Consulted

- The Toronto Star article: “Budget 2025: key numbers from the Liberals’ latest spending plan” – https://www.thestar.com/politics/federal/budget-2025-key-numbers-from-the-liberals-latest-spending-plan/article_5f6a52fd-1847-53ba-80fb-ae0f807c0cad.html

- Official Budget 2025 overview – https://www.budget.gc.ca/2025/2025budget/

The linked Budget 2025 page provided the detailed fiscal tables and policy descriptions that underpin the numbers cited above.

Read the Full Toronto Star Article at:

[ https://www.thestar.com/politics/federal/budget-2025-key-numbers-from-the-liberals-latest-spending-plan/article_5f6a52fd-1847-53ba-80fb-ae0f807c0cad.html ]