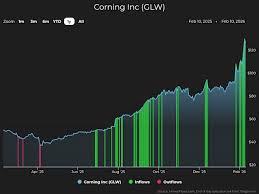

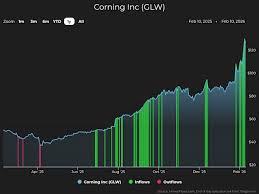

Corning's AI Transformation Drives Stock Surge

Investopedia

InvestopediaLocales: Pennsylvania, Ohio, UNITED STATES

Friday, February 20th, 2026 - Corning (COR) has emerged as a standout performer in the stock market this year, defying expectations for a company with roots stretching back to 1857. While traditionally known as a world leader in glass manufacturing - think Gorilla Glass protecting your smartphone screen - the company's recent surge isn't a result of simply making better glass. It's a story of successful technological transformation, fueled by a strategic and comprehensive embrace of artificial intelligence (AI).

For a company often perceived as a mature industrial player, Corning's current trajectory is remarkable. A recent interview with Chief Technology Officer Jeff Mazur shed light on the core driver behind this success: AI. But the implementation isn't about flashy robotics or replacing the workforce. It's a deeply integrated, data-driven approach impacting every facet of their manufacturing process, from predictive maintenance to quality control and workflow optimization.

Beyond Prediction: A Holistic AI Strategy

While predictive maintenance - anticipating equipment failures before they occur - is a key component, Corning's AI initiatives represent a much broader application of the technology. The company isn't just looking at when things might break, but how to prevent breakdowns, how to produce flawless glass, and how to maximize efficiency throughout the entire operation. This holistic view sets them apart.

Specifically, Corning is employing AI-powered systems for three core areas:

- Predictive Maintenance: This has become almost table stakes for modern manufacturing. Corning's system collects real-time data from sensors embedded in its manufacturing equipment. AI algorithms analyze this data - vibration, temperature, performance metrics - to identify subtle anomalies that might indicate an impending failure. This allows for scheduled maintenance during planned downtime, preventing costly and disruptive unplanned outages. What's notable is the scale of this implementation across all their facilities.

- Automated Quality Control: Traditionally, quality control involved manual inspection of glass sheets, a process prone to human error and limitations. Corning's AI-powered vision systems now analyze glass surfaces with far greater precision, identifying even microscopic defects invisible to the naked eye. This has dramatically reduced waste, improved consistency, and boosted product yields. The system learns and improves over time, becoming more adept at identifying nuanced imperfections.

- Production Workflow Optimization: This is where Corning is truly differentiating itself. AI algorithms analyze the entire production process, identifying bottlenecks, inefficiencies, and areas for improvement. This isn't about simply speeding up individual machines; it's about optimizing the flow of materials and information through the factory, streamlining processes and maximizing throughput. This has led to significant reductions in production costs and improved on-time delivery.

AI as Augmentation, Not Replacement

A crucial aspect of Corning's AI strategy, repeatedly emphasized by Mazur, is that it's designed to augment human capabilities, not replace them. The company recognizes that its skilled workforce possesses invaluable knowledge and experience. AI is deployed to automate repetitive, mundane tasks, freeing up employees to focus on more complex problem-solving, innovation, and strategic decision-making. This approach fosters a positive work environment and ensures that Corning retains its institutional knowledge.

"We're not trying to automate people out of jobs," Mazur stated. "We're trying to empower them with better tools and insights, allowing them to be more effective and productive."

The Investor Response and Future Outlook

Investors have clearly recognized the transformative impact of Corning's AI investments. The company's stock price has soared, making it one of the best-performing stocks of the year. Analysts point to the improved efficiency, reduced defect rates, and increased profitability as key factors driving this growth.

Looking ahead, Corning is poised to continue leveraging AI to drive innovation and expand its market leadership. The company is actively exploring new applications of AI in areas such as materials science, new product development, and supply chain optimization. They are also investing heavily in AI talent and infrastructure.

Corning's journey serves as a compelling case study for other established industrial companies seeking to navigate the digital age. It demonstrates that embracing AI isn't just about adopting the latest technology; it's about fundamentally rethinking processes, empowering employees, and building a data-driven culture. By transforming itself from a traditional glassmaker into an AI-powered tech leader, Corning has not only revitalized its business but also positioned itself for sustained success in the years to come. The market is watching closely to see if other legacy manufacturers can replicate this success story.

Read the Full Investopedia Article at:

[ https://www.investopedia.com/ai-made-this-glass-maker-one-of-the-year-s-hottest-stocks-11910981 ]